WYOMING 2100

If we want Wyoming to still be a viable state at the next turn of the century, we shouldn’t let it go bankrupt.

The biggest threat to our State’s solvency is our government pension systems.

The biggest threat to our State’s solvency is our government pension systems.

We can keep our promises to our current pension recipients and still save the State; we just have to stop adding more people to the pension system. After establishing a transition date, future government employees would receive a defined contribution retirement benefit every year.

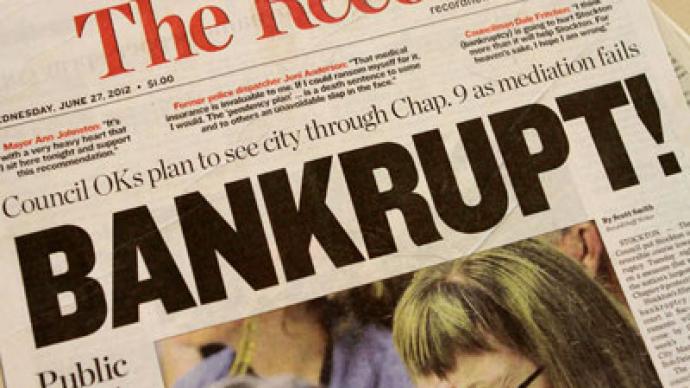

Unlike Detroit municipal pensioners who will receive a much reduced retirement (if any), our Wyoming government workers will retire to an intact and funded system.

We can keep our promises to our current pension recipients and still save the State; we just have to stop adding more people to the pension system. After establishing a transition date, future government employees would receive a defined contribution retirement benefit every year.

Or we could fully fund our current pension plan and use a realistic estimated interest rate on the investments.

Every interested party in this issue would benefit from this change, every one.

Current employees expecting a pension would receive their pension. By closing the pension system to new recipients, they would be much more statistically likely to receive their pension as the system would not go bankrupt, like every other government pension system is expected to do.

Current employees expecting a pension would receive their pension. By closing the pension system to new recipients, they would be much more statistically likely to receive their pension as the system would not go bankrupt, like every other government pension system is expected to do.

Unlike Detroit municipal pensioners who will receive a much reduced retirement (if any), our Wyoming government workers will retire to an intact and funded system.

Young citizens of Wyoming, and their children, and their grandchildren,

would celebrate that we are not dumping this unfunded debt on their generations. Anyone who says they care for the children can’t honestly defend sustaining the current pension system without substantial reform.

would celebrate that we are not dumping this unfunded debt on their generations. Anyone who says they care for the children can’t honestly defend sustaining the current pension system without substantial reform.

Future state, county and municipal employees will receive their retirement contribution every year that they work and will be able to invest it as they see fit, controlling their individual investments.

They will not be vulnerable to an empty promise that one day they will receive a pension. Statistically this is very unlikely as no government pension is fully funded, not even Wyoming’s, which is the second best in the country for funding.

Future state, county and municipal employees will receive their retirement contribution every year that they work and will be able to invest it as they see fit, controlling their individual investments.

They will not be vulnerable to an empty promise that one day they will receive a pension. Statistically this is very unlikely as no government pension is fully funded, not even Wyoming’s, which is the second best in the country for funding.

Pensions are a sneaky way for politicians to hide debt by putting this obligation off into the nebulous future without any exact numbers. Promises to give retirees pensions can never predict life span, pension fund investment returns or the actual exact impact of cost-of-living increases because they all interact to effect the monthly pension obligation at some future time.

Pensions are a sneaky way for politicians to hide debt by putting this obligation off into the nebulous future without any exact numbers. Promises to give retirees pensions can never predict life span, pension fund investment returns or the actual exact impact of cost-of-living increases because they all interact to effect the monthly pension obligation at some future time.

The two basic paths to keeping our pension promises to our government employees, our friends, family and neighbors, is to either close it to new participants and change it to a defined contribution system or to simply and honestly fully fund the pension with a realistic interest rate.

Anything less than those two options is a lie to ourselves, a Wyoming Planned Poverty Project to break the state’s finances in as soon as ten years to fail to pay the full pension to those who earned it.

And we can still fix this problem today.

Anything less than those two options is a lie to ourselves, a Wyoming Planned Poverty Project to break the state’s finances in as soon as ten years to fail to pay the full pension to those who earned it.

And we can still fix this problem today.

FOLLOW Wyoming2100

It’s time to talk to your mayor, your county commissioner and your state representatives about what you believe will ensure a Wyoming we recognize in the next future.